Menu

Steps In

Steps Out

Outlook

Rationale

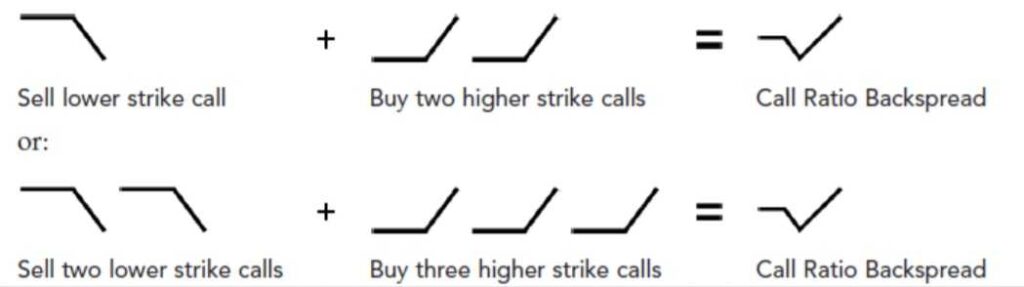

Net Position

Effect of Time Decay

Time Period to Trade

Breakeven Down = [Lower strike + net credit]

Breakeven Up = [Higher strike price + (difference in strike prices * number of short calls)/(number of long calls -number of short calls) – [net credit received] or + [net debit paid]]

Exiting the Position

Mitigating a Loss

Advantages

Disadvantages

Share this Content

© 2021 All rights reserved

Ask Your Query