Menu

Outlook

Rationale

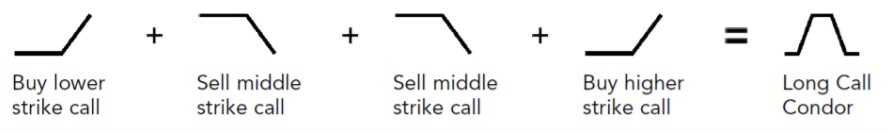

Net Position

Effect of Time Decay

Time Period to Trade

Breakeven Down = [Lower Strike + Net Debit]

Breakeven Up = [Higher Strike – Net Debit]

Steps In

Steps Out

Exiting the Position

Mitigating a Loss

Advantages

Disadvantages

Share this Content

© 2021 All rights reserved

Ask Your Query