Menu

Steps In

⇒Try to ensure that the trend is downward and identify a clear area of resistance.

Steps Out

⇒Manage your position according to the rules defined in your Trading Plan.

⇒If the stock falls by more than the call premium, then you’ll make a profit at expiration.

⇒If the stock rises above your stop loss, then exit by either reversing your position or simply buying back the stock and keeping the Long Call up to a new profit objective.

Outlook

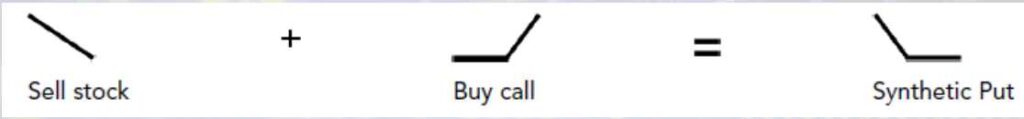

⇒With Synthetic Calls, your outlook is bearish.

Rationale

⇒To create the bearish risk profile of a put option but to take in a net credit by selling the stock short.

⇒If the stock falls, you can make a profit.

⇒If the stock rises, you will lose money, but your losses will be capped at the level of the call strike price to the call premium plus the difference between the stock price and call strike price.

Net Position

⇒If you’re trading stocks, this is a net credit trade.

⇒Your maximum risk is limited if the stock rises.

Effect of Time Decay

⇒Time decay is harmful to the value of the call you bought.

Appropriate Time Period to Trade

⇒Buy the call with as long a time to expiration as you need the insurance . You can avoid the worst effects of time decay.

Breakeven = [Strike price – Call Premium]

Exiting the Position

⇒ If the share rises above the strike price, you will make a limited loss.

⇒If the share falls below the stock price (plus premium you paid), you will

make a profit.

⇒For any exit, you can either buy the stock or sell the call or both.

⇒If the share falls and you believe that it may rise afterwards, then you

can just buy the stock and wait for the call to regain some of its value

before selling that, too.

Mitigating a Loss

⇒You have already mitigated your losses by buying the calls to insure your

long stock position

Advantages

⇒Replicate a put and profit from declining stocks with no capital outlay.

⇒Limited risk if the stock rises.

⇒Uncapped reward if the stock falls.

Disadvantages

⇒More complex than simply buying puts.

⇒Time decay will erode the value of the call you buy, while buying a long-term call will detrimentally affect your risk profile.

⇒Use the call as insurance against the stock rising.

© 2021 All rights reserved

Ask Your Query