Menu

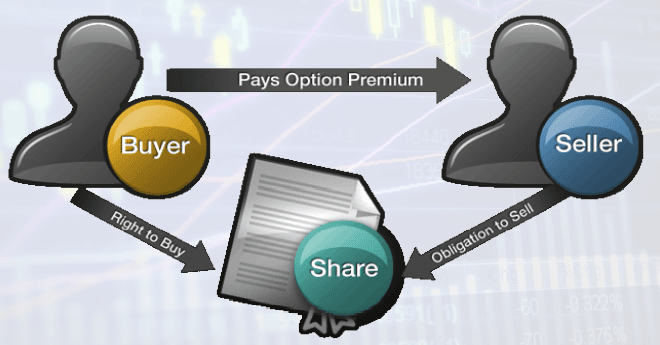

A buyer of a call option has the right to buy the underlying asset for a certain price.

The buyer of a put option has the right to sell the underlying asset for a certain price.

• Basic English meaning of Swap is exchange or exchange a thing in return of another.

• In finance, the Swaps definition is nothing but the exchange of cash flows.

• Or in other words, we can define it as an OTC derivative contract between two parties exchanging a sequence of cash flows with another at a predetermined rate in the future period mutually agreed between them.

Share this Content

© 2021 All rights reserved

Ask Your Query